- Wicked Club

- Posts

- 👶 The Young Adult's Credit Card Blueprint: When and Which Cards to Choose

👶 The Young Adult's Credit Card Blueprint: When and Which Cards to Choose

Explained Inside: How to Rebuild Your Credit After a Natural Disaster

Hey, Wicked Club fam!

Happy October! 🍁 I’m really excited about all the festivities and holidays coming up soon. This time of year brings so many wonderful celebrations, from American holidays to my favorite Nepali festivals. With Dashain and Tihar just around the corner, I can’t help but feel nostalgic for home and the festivities. Wishing you all a joyful Dashain if you celebrate! 💐

As we gear up for celebrations, let’s focus on being smart and savvy with our spending this season. We’re here to support you in making the best financial decisions! With that in mind, let’s jump into this week’s topics!

🗒️ This week’s rundown:

👶 The Young Adult's Credit Card Blueprint: Exactly When to Get Which Card

One of the common questions we get asked at Wicked Pay is, “What card should I get next?” And almost every time, my answer is the same, it depends. To choose your next credit card, it's essential to know your financial goals, spending habits, and overall financial health. Be sure to check out our previous issue, where I dive into how to determine what to prioritize when selecting a new card.

In this guide, though, I want to focus on helping young adults get started with credit cards. I'll outline a strategic approach designed for those aged 18 and beyond, showing you exactly how to build credit wisely and maximize your benefits as you grow.

1️⃣ Starting Small with a Debit Card (Ages 16-18)

Before you dive into credit, it's a good idea to start with a debit card. This helps you build responsible spending habits, and understand how to manage money, as you can only spend what’s in your bank account.

Why start with a debit card?

No debt: You’re spending money you already have, so there’s no risk of overspending or interest charges.

Learn budgeting: It’s a great way to practice tracking your spending without worrying about a credit limit.

Once you’ve developed some solid financial habits and a relationship with your bank, you’re ready to move on to building your credit.

2️⃣ Enter the World of Credit (Ages 18-19)

Now that you're comfortable managing your finances, it's time to take the first step into credit cards.

Start with a Secured Credit Card

Why: This helps you start building credit while learning how to use credit responsibly.

What to get: Look for cards like the Discover it Secured or Capital One Platinum Secured.

How it works: You’ll need to put down a deposit (usually $200–$500), which acts as your credit limit.

Remember:

Always pay your bill in full and on time.

Keep your credit usage below 30% of your limit.

3️⃣ Level Up Your Credit Game (Ages 19-20)

Once you've built some credit history, it's time to unlock better opportunities.

Get a Student Credit Card

Why: Continue building credit while earning rewards.

What to get: Consider cards like Discover It Student Cash Back or Chase Freedom Student.

Perks: No annual fees and the chance to earn cash-back rewards.

Focus: Keep using credit responsibly while enjoying your first rewards!

4️⃣ Expand Your Rewards (Ages 20-22)

With a strong foundation, you're now ready to access more rewarding credit options.

Go for Entry-Level Rewards Cards

Why: Earn more rewards on everyday purchases.

What to get: Check out Chase Freedom Unlimited or Capital One Quicksilver.

Strategy: Use these cards for regular expenses like restaurants, groceries, or gas to maximize cash back.

5️⃣ Optimize Your Points (Ages 22-24)

Now it’s time to start thinking strategically.

Use Category-Specific Rewards Cards

Why: Maximize rewards by focusing on specific spending categories.

What to get: Try Chase Freedom Flex, Citi Custom Cash, and Bilt Mastercard.

Pro Tip: Use different cards for different types of spending (groceries, dining, etc.) to earn the most rewards possible.

6️⃣ Explore Travel Rewards (Ages 24-26)

As your lifestyle evolves, your credit card strategy should too.

Get a Travel Rewards Card

Why: Time to start earning points for travel!

What to get: Consider Capital One Venture, Chase Sapphire Preferred, and Amex Gold.

Bonus: Learn how to transfer points to travel partners for extra value on flights and hotels.

7️⃣ Go Premium (Ages 26+)

If you’re ready for serious perks, it’s time to consider premium cards.

Premium Rewards Cards

Why: Access top-tier travel benefits and accelerated rewards.

What to get: Look into American Express Platinum or Chase Sapphire Reserve.

Perks: Lounge access, travel credits, and elite status benefits.

⭐️ Golden Rules for Your Credit Journey

Always pay off your balance in full and on time.

Keep your credit utilization low—aim for under 10%, and never exceed 30%.

Adjust your credit card strategy as your lifestyle changes.

Stay informed about new card offers and benefits.

Consider product changes to preserve your credit history length by keeping older accounts active.

Remember, this is a general guide. Your credit path may vary based on your financial situation and goals. Start with a debit card, build good habits, and then gradually move into the credit world with confidence. By following these steps, you’ll build a strong credit history, maximize rewards, and set yourself up for long-term financial success. Take control of your credit journey, and you’ll reap the rewards for years to come!

P.S. If you want to learn more about the cards I mentioned, be sure to check out the “Card Explorer” feature in our mobile app. With information on nearly 4,000 credit cards all in one place, it’s easy to explore and compare your options!

🌪 Rebuilding Your Credit After a Natural Disaster

In the wake of Hurricane Helene, it's heartbreaking to hear about the lives lost and entire communities being “wiped off the map.” 💔 When natural disasters hit, worrying about your credit is probably the last thing on your mind—rightfully so! But once things settle and everyone’s safe, it's time to shift focus to your finances. It only takes one rough incident to spiral into a financial nightmare that could stick with you for years.

The good news? You can still take steps to protect your credit and prevent long-term damage. Here's how to stay financially strong, even when life throws you a hurricane. 💪

Contact Your Creditors Immediately

As soon as it's safe to do so, reach out to your creditors to explain your situation. Many lenders offer disaster relief programs that can include:

Temporary payment suspensions

Waived late fees

Reduced interest rates

Extended payment terms

Don't wait for bills to pile up. Proactive communication can help prevent negative marks on your credit report. And please ask your creditors about all the available options that can help you through these tough times.

Review Your Credit Reports

In times of crisis, it's crucial to monitor your credit closely. Request free credit reports from all three major bureaus (Experian, Equifax, and TransUnion) to check for any errors or fraudulent activity. Dispute any inaccuracies you find promptly.

Consider a Credit Freeze

If you're concerned about identity theft in the chaos following a disaster, placing a credit freeze can provide an extra layer of protection. This prevents new accounts from being opened in your name without your explicit permission.

Prioritize Essential Payments

If resources are limited, focus on making payments for secured debts like mortgages and car loans first. These typically have the most significant impact on your credit score and financial stability.

Utilize Available Assistance Programs

Research and take advantage of disaster relief programs offered by:

Federal Emergency Management Agency (FEMA)

Disaster Assistance through the Small Business Administration (SBA)

Local and state government agencies

Non-profit organizations

These programs can provide financial assistance to help you stay afloat and maintain your credit standing.

Document Everything

Keep detailed records of all communications with creditors, insurance companies, and assistance programs. This documentation can be invaluable if you need to dispute any credit issues later.

Be Wary of Scams

Unfortunately, disasters often bring out scammers looking to take advantage of vulnerable individuals. Be cautious of unsolicited offers for credit repair or debt relief services. Stick to reputable organizations and verify all offers before providing personal information.

Consider Credit Counseling

If you're struggling to manage your debts after a disaster, seek help from a non-profit credit counseling agency. They can provide guidance on budgeting, debt management, and communicating with creditors.

Look into Forbearance Options

For major loans like mortgages, ask about forbearance programs. These can temporarily pause or reduce your payments without negatively impacting your credit score.

Remember, recovering from a disaster is a process. By taking these steps to protect your credit, you're laying the groundwork for a stronger financial future as you rebuild. Don't hesitate to seek professional financial advice if you need additional support during this challenging time.

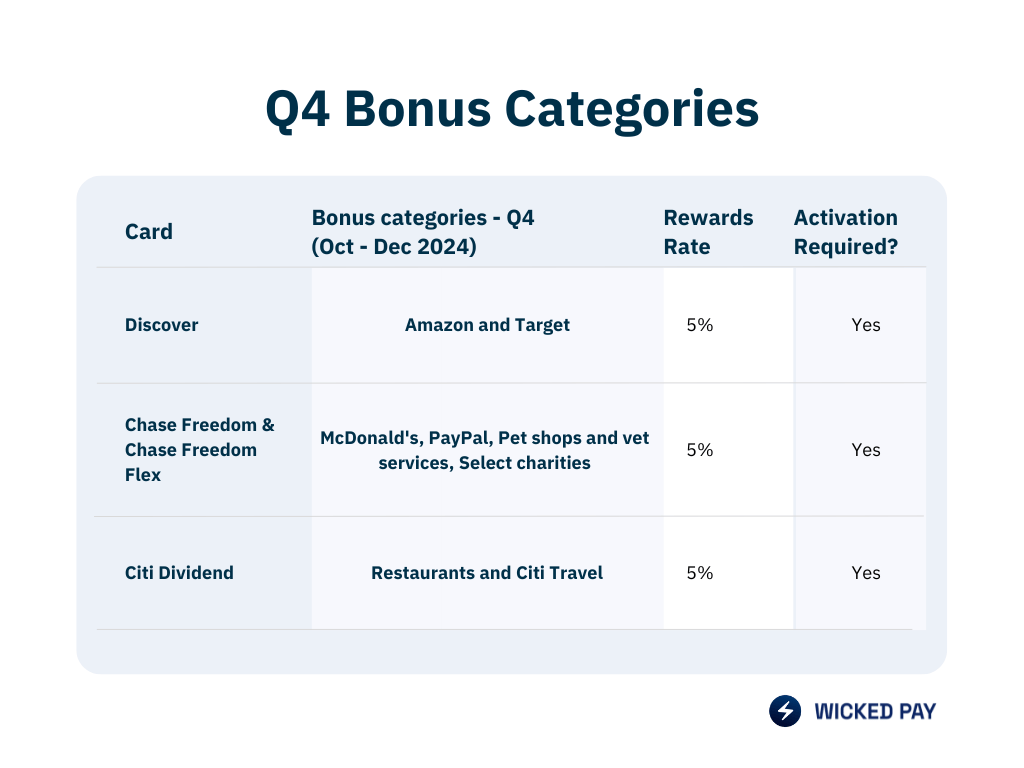

🔔 Quarterly Reward Activation Reminder

It’s October! We have officially entered quarter 4, and the rotating categories have now changed for certain popular cards! Remember to activate these rewards on your account to ensure you receive all the cashback!

🚀 Action Items for Wicked Club Fam

🔍 Got questions? We've got answers! Don't hesitate to reach out if you have anything on your mind about the app.

⬇️ Want to optimize your credit card rewards? Download our app to start maximizing your rewards today!

🚀 Been a tester of our Wicked Pay app? We value your early insights. Share your thoughts through our survey form here.

📰 New to the crew? Subscribe to our newsletter for all the latest updates, and spread the word to your friends!

💬 Connect with fellow credit card enthusiasts? Join our Discord server for the beta testers and other credit card enthusiasts here.

✨Want to see behind the scenes of how we’re building Wicked Pay? Follow our CEO Pooja on Instagram at @poojabuilds.

Well, that’s a wrap for this week. Don’t be shy to forward this email to your friends and family if you found any of this helpful, after all, sharing is caring :) I’ll see you guys on the next one. Until then, take care and stay safe!

Love,